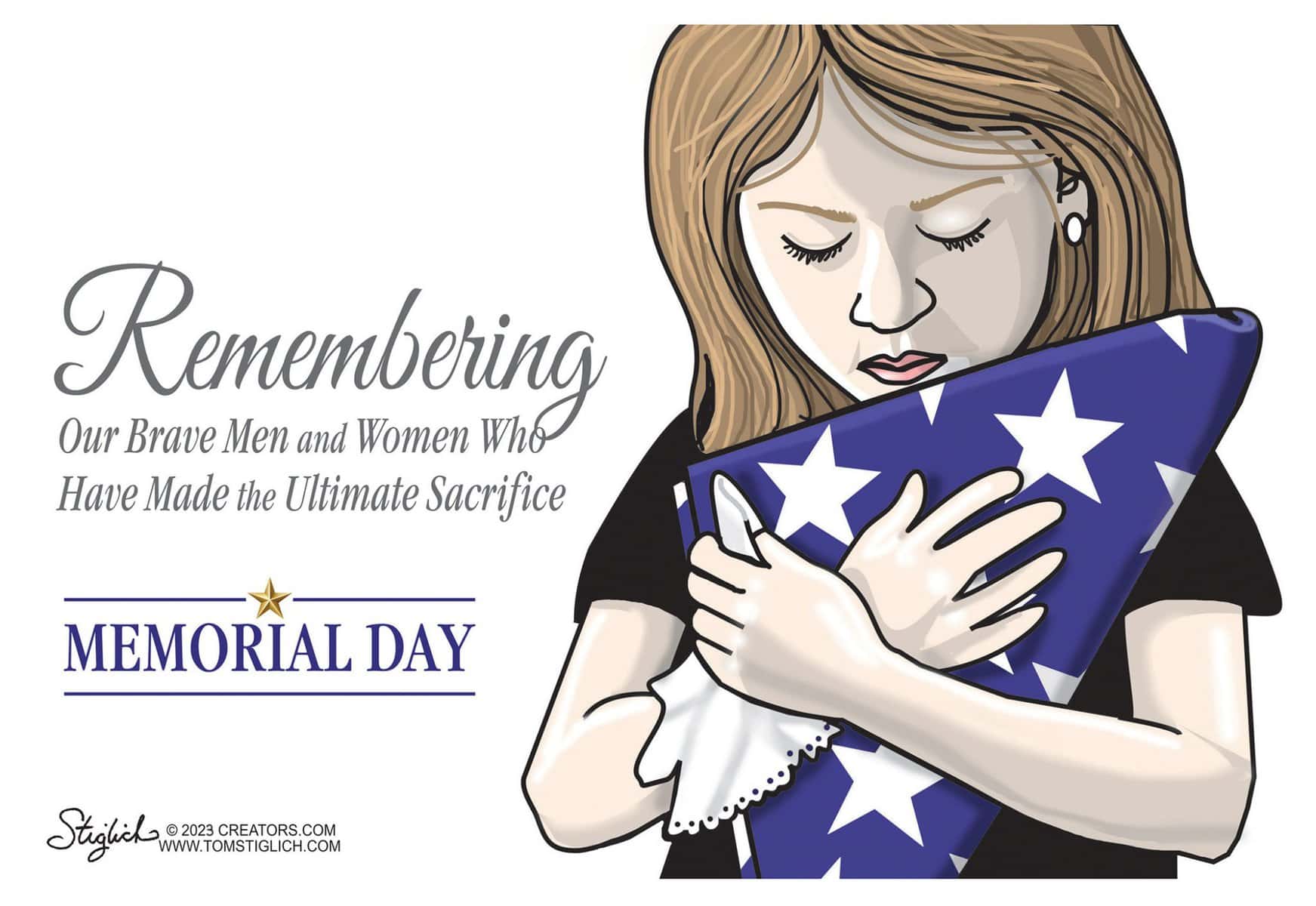

Help repair Vietnam Veterans Memorial

Philadelphia’s Vietnam Veterans Memorial, located at 108 Spruce St., near Penn’s Landing, was badly vandalized last August, with the thief making off with brass lighting plate covers and custom-made concrete skateboard barriers.

Despite IBEW Local 98 stepping up to offer to cover all costs of the labor required to repair the extensive damage, officials of the Vietnam Veterans Memorial just announced that they still need $50,000 to cover the costs of materials. IBEW Local 98, which has long supported military vets, police officers, firefighters and all first responders, is leading a fundraising effort on behalf of the Memorial.

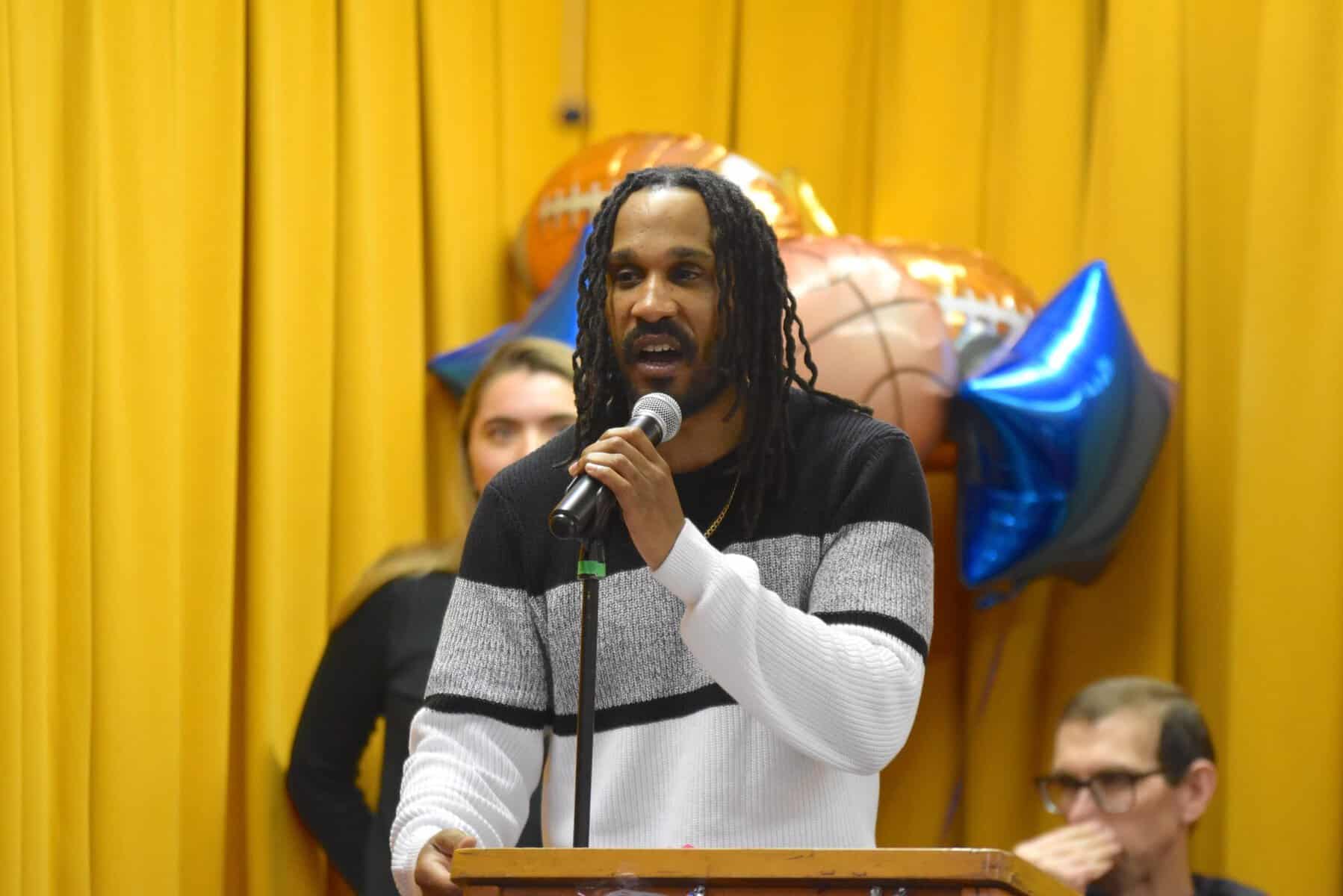

“Approximately 58,000 members of the U.S. military died in service to our nation in the Vietnam War, many of them Philadelphians,” said Mark Lynch Jr., Business Manager of IBEW Local 98. “Our city’s Vietnam Veterans Memorial is a beautiful, moving tribute to those brave men and women who made the ultimate sacrifice in defense of our nation. The fact that someone would vandalize it is a disgrace. It’s now up to everyday Philadelphians, as well as to our corporate and philanthropic communities, to raise the funds needed to return the Memorial to its original glory.”Checks payable to “Philadelphia Vietnam Veterans Memorial” can be mailed to the Philadelphia Vietnam Veterans Memorial, P.O. Box 29425, Philadelphia, PA 19125. You can also make a secure online donation on the Vietnam Veterans Memorial website (https://pvvm.org/).

City wins $1.47M grant for Electric Vehicle jobs

The City of Philadelphia was awarded $1.47 million in federal funds from the U.S. Joint Office of Energy and Transportation, supported by the Vehicle Technologies Office, through the Ride and Drive Electric grant program to fund the Plug In Philly initiative. The pilot is a workforce development program developed to recruit and train 45 “diverse” Philadelphians for careers in electric vehicle supplies and equipment. The award comes from the $46.5 million made available by the Joint Office – established under the Bipartisan Infrastructure Law – for projects that bolster America’s electric vehicle charging infrastructure.

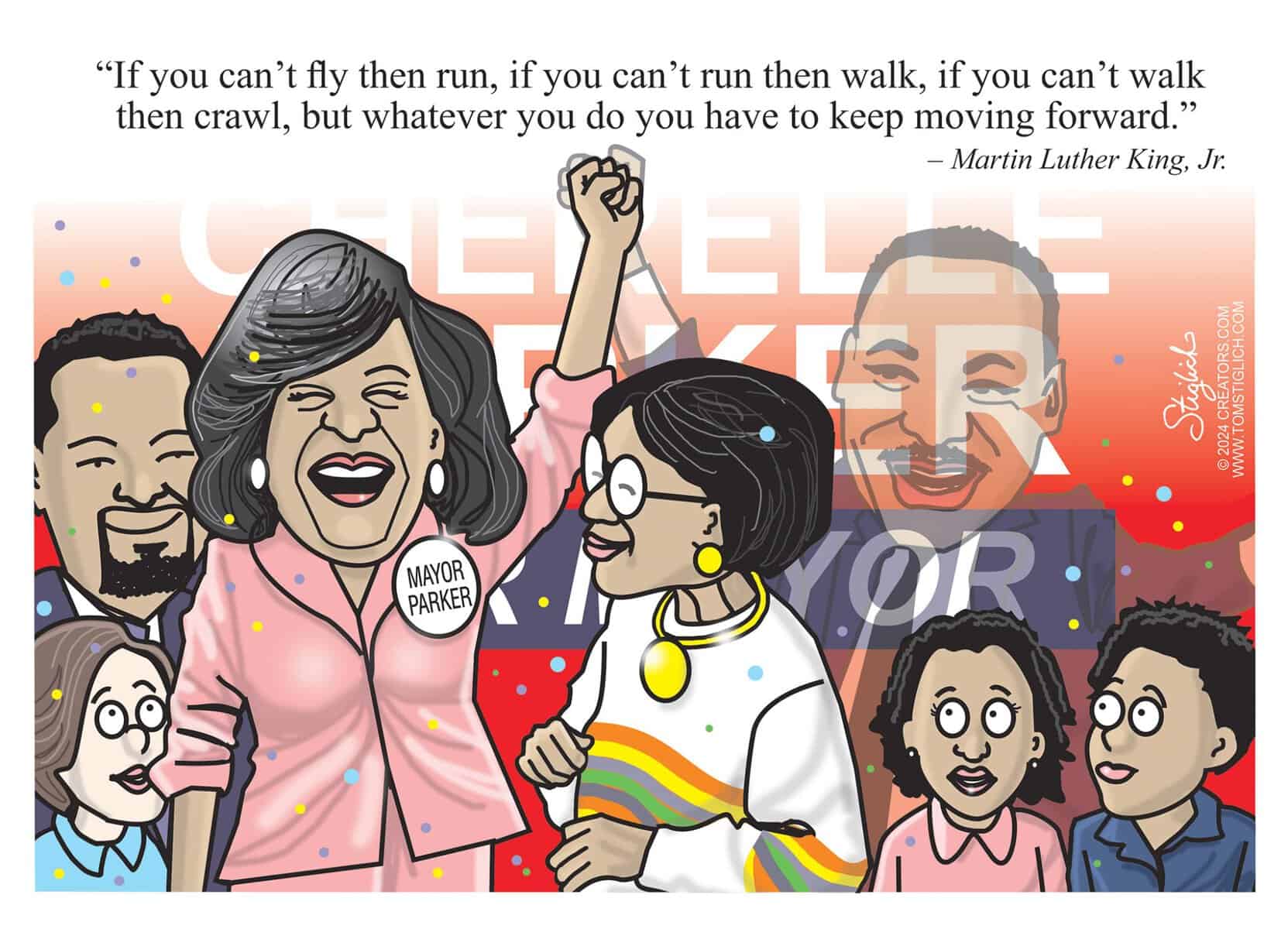

“Through a powerful partnership between the federal government, organized labor, education and the City of Philadelphia, this initiative harnesses the potential for ‘underserved’ Philadelphians to obtain pathways to jobs, careers and self-sufficiency,” said Mayor Cherelle Parker. “The ‘Plug In Philly’ program will expand economic opportunity for all by removing barriers to employment for Philadelphia residents. The pre-apprenticeship model will provide participants with training in an electric vehicle field that is booming, and provide increased pathways to local unions responsible for building and maintaining Philadelphia’s infrastructure. We also thank the Biden-Harris administration – without their leadership on the bipartisan infrastructure law — this grant would never have happened.”

Plug In Philly will empower aspiring EVSE workers. This pre-apprenticeship program will expand access to career-track training and employment in EVSE installation and maintenance work. Ultimately, Plug In Philly will increase and diversify the workforce needed to make a regional EV charging station network possible.

“As electric vehicle production booms thanks in no small part to the infrastructure law, this federal funding will help the ‘Plug In Philly’ program to bolster the EV workforce and train workers for good-paying union jobs,” said U.S. Sen. Bob Casey. “Pennsylvania was among the first states in the nation to begin building out a statewide network of charging stations with infrastructure law funds and now this grant will ensure Southeastern Pennsylvanians of all backgrounds can train for jobs to build this network out, strengthening our burgeoning electric vehicle industry and reducing our carbon footprint.”

The city will lead the initiative in partnership with the International Brotherhood of Electrical Workers Local 98 and its training arm, Apprentice Training for the Electrical Industry. Additional partners include Philadelphia Works Inc., Community College of Philadelphia, School District of Philadelphia and National Association of Women in Construction Philadelphia chapter ,which will help recruit participants, develop curriculum and provide training.

“IBEW Local 98 and our Apprentice Training program are deeply honored to be partnering with the Parker administration, Philadelphia Community College and other city stakeholders on this innovative new workforce development program,” said Mark Lynch Jr., business manager, IBEW Local 98. “This is a game-changer that perfectly dovetails with our commitment to providing women and minorities with greater access to our union through innovative pre-apprenticeship programs and community outreach.”

During the two-year pilot, a total of 45 participants over three cohorts will successfully complete the pre-apprenticeship program, and City officials are committed to helping these participants access pathways to permanent, fulltime jobs in the EV industry. Long-term aims include an increase in “BIPOC” and women electricians employed by 2030 on Philadelphia public works projects.

“This grant announcement demonstrates the city’s successful intergovernmental approach to bring $1.47M in federal infrastructure funding to the people of Philadelphia,” said Mike Carroll, deputy managing director for the city Office of Transportation, Infrastructure and Sustainability. “The focus on electric vehicle workforce training builds clean transportation for Philadelphia resulting not only in a city that is safer, cleaner and greener, but one which creates economic opportunity for all.”

Philadelphia House delegation praises expanded state Child and Dependent Care Enhancement Tax Credit

Members of the Philadelphia House Delegation held a news conference at the Early Learning Literacy Academy highlighting the expansion of the state Child and Dependent Care Enhancement Tax Credit.

The tax credit eases the burden for working families who pay for and rely on child and dependent care in order to work. These families claim the credit when they file their federal and state tax returns.

Over 27,000 working parents in Philadelphia will see their state tax credits more than triple under the expanded credit.

“Families shouldn’t have to choose between going to work and having quality care for a loved one, or have to work just to pay for care,” said Philadelphia House Delegation Chair Morgan Cephas. “We fought and won for working families prioritizing this significant increase in the Child and Dependent Care Enhancement Tax Credit. I’m elated to know that so many families across Philadelphia will greatly benefit from this increase.”

Pennsylvania will now provide a 100% match to the federal tax credit. Prior to this expansion the tax credit was equal to 30% of the federal credit.

“House Democrats are delivering for all Pennsylvanians – from our students to our seniors to our working families,” said House Speaker Joanna McClinton. “Pennsylvania’s improved Child and Dependent Care Tax Credit will help families balance their budgets and businesses whose employees depend on reliable and consistent childcare to go to work.”

The previous one-child credit of $180 goes up to as much as $1,050 depending on household income and expenses for 2023 tax returns. The previous two-or-more children credit of $360 goes up to as much as $2,100 depending on household income and expenses.

“This expanded tax credit for working families is what a people-first agenda looks like,” said House Appropriations Committee Chairman Jordan Harris. “House Democrats continue moving legislation in a direction that will improve the lives of all Pennsylvanians, young and old, and we look forward to continuing to do what’s best to improve communities in Philadelphia and around the state.”

People who qualify for the federal credit also qualify for the state credit.

“The Child and Dependent Tax Credit enhancement is not only about fiscal policy and numbers – it’s lifechanging support for families, empowering them to succeed in fulfilling careers without the financial burdens,” said state Rep. Malcolm Kenyatta. “It stands as a testament to Democrats’ commitment to empowering families, ensuring that every child’s potential is nurtured, and every family’s journey is marked by opportunity and shared success.”

The legislators were joined by daycare workers and parents who will benefit from this increased tax credit, including LaToya Monroe, executive director and owner, Early Literacy Academy; Damaris Alvarado-Rodrigues, executive director and owner, Children’s Playhouse; and Areyenis “Ms. Genie” Perry, parent and teacher at Early Literacy Academy.

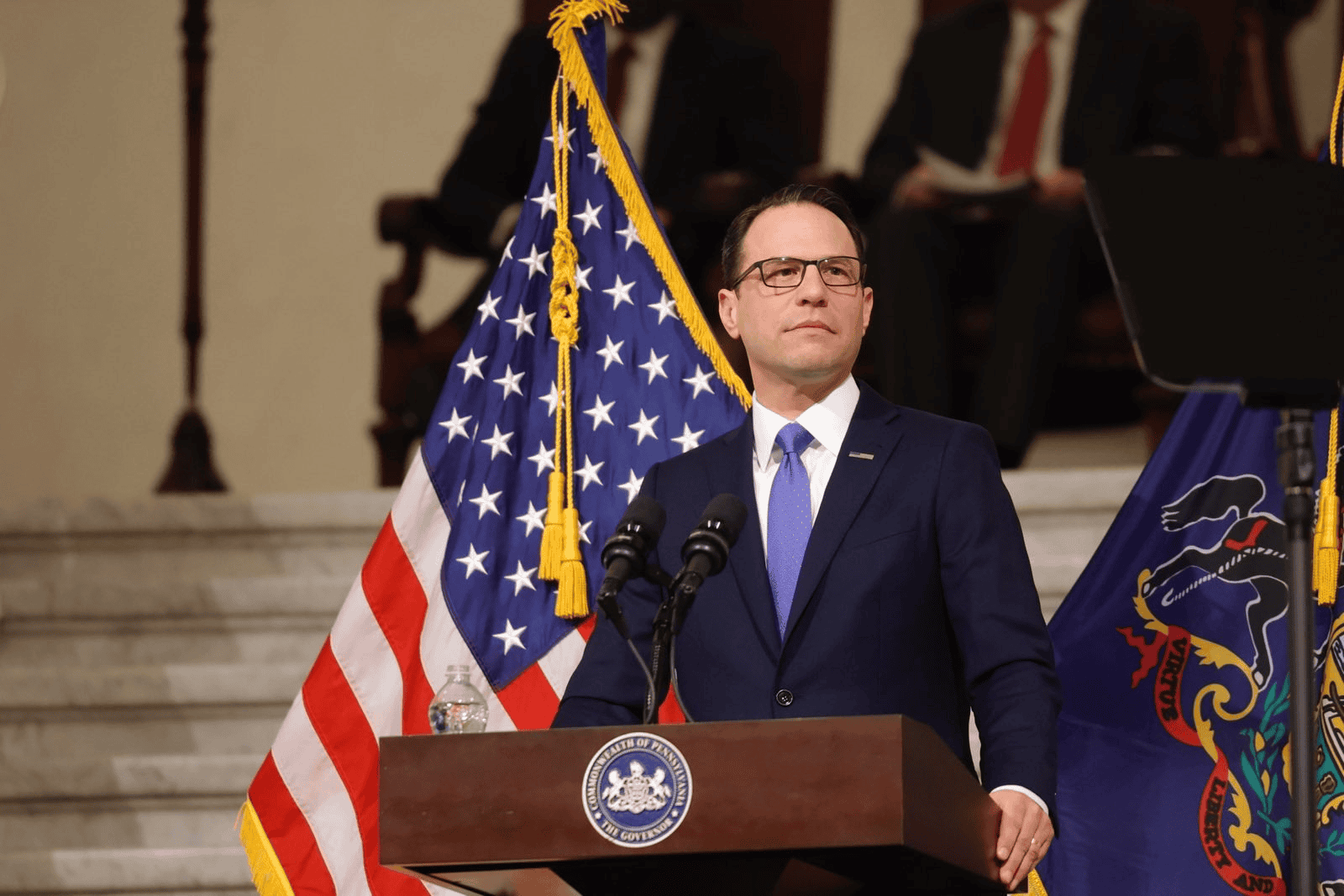

Shapiro administration announces $75M in public school environmental grants

The state Department of Education announced $75 million in grant funding to help schools to make environmental repairs and improvements.

“Preparing and nurturing the next generation of successful Pennsylvanians starts with making sure all students have a safe, healthy environment to learn in,” said Secretary Dr. Khalid N. Mumin. “These grants help school districts make necessary upgrades and repairs to their buildings and learning spaces to ensure that our students and school staff have safe air to breathe, water to drink and classrooms to learn in.”

Eliminating lead and asbestos along with other environmental contaminants in schools lowers cumulative exposure across childhood, leads to better cognitive and overall health outcomes for children, and increases the likelihood of academic and career success, the PDE said.

The grant program focuses on remediating and abating environmental hazards in schools to create safe, healthy learning environments for students and staff. The 2023-24 enacted budget allocated $75 million for the program, and is open to school districts, career and technical centers and charter schools.

PDE will accept applications from May 1 through June 30. Schools may apply for funding to abate or remediate environmental hazards, including lead in water sources, asbestos and mold inside school buildings. Entities may apply for funding for eligible expenses incurred on or after July 1, 2023.

School entities may apply using the PDE’s School Construction and Maintenance Management system, accessible through MyPDESuite.

The 2023-24 budget also earmarked $100 million for the Department of Community and Economic Development’s Public School Facility Improvement Grant Program, which provides grants for heating and air conditioning upgrades, window replacement, lead and asbestos abatement, and other improvement projects for eligible schools. DCED will begin accepting applications March 1.

Addiction recovery nonprofits can apply for microgrants

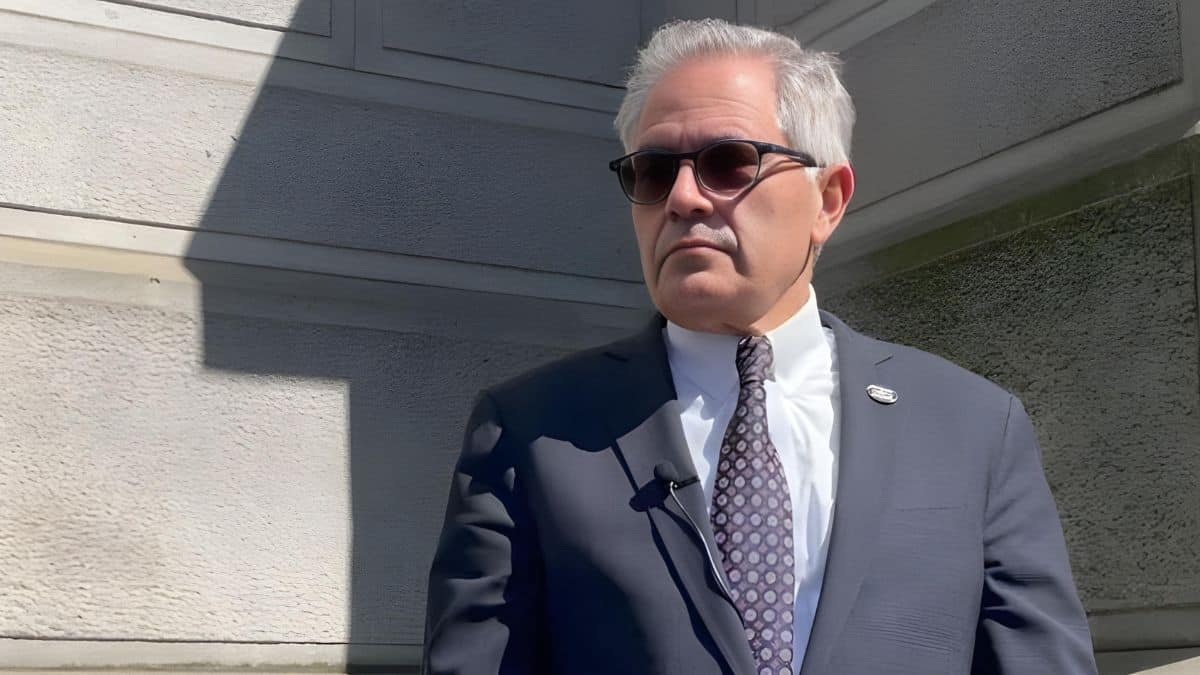

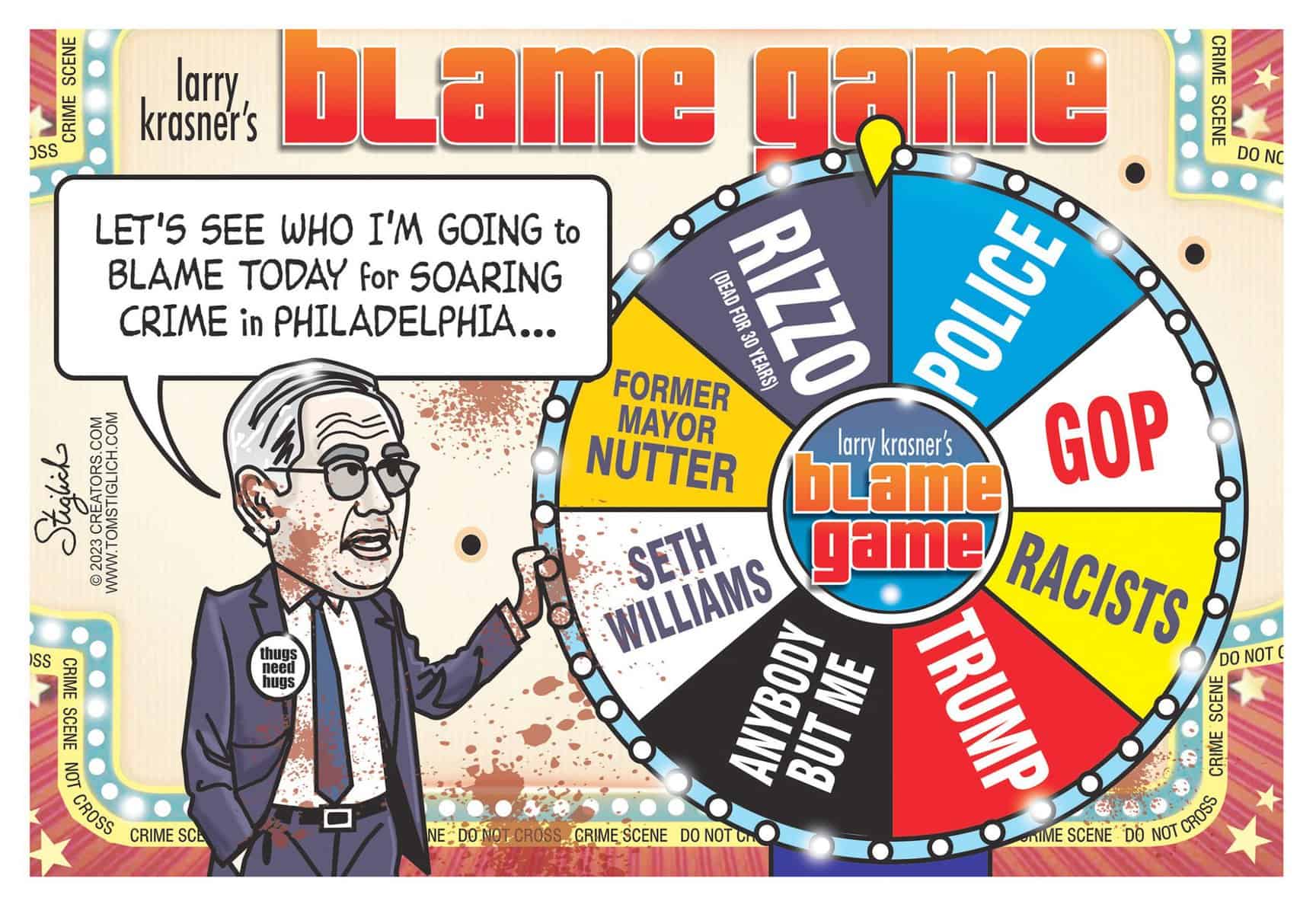

District Attorney Larry Krasner and the Philadelphia Foundation announced the reopening of the application process for the District Attorney’s Office Violence Prevention Grant Program. Specifically, the DAO and Foundation are encouraging local, community-based 501(c)(3) organizations that provide supports to people in active addiction and those who are in recovery to apply for financial assistance.

A report issued by the city Department of Public Health last October found that over 1,400 fatal overdoses — an 11% increase and a record for the city — occurred in Philadelphia in 2022. The report also indicated that fatal overdoses are disproportionately impacting black communities.

“The appropriate use of civil forfeiture means taking money away from drug dealers and other threats to the community,” Krasner said. “But we don’t stop there. This administration believes that in order to prevent drug addiction and violence, we must reinvest in the communities hardest hit by these public health and safety issues. That’s why we are strongly encouraging small, local community-based groups to apply for these funds. Let’s work together to make our city safer and healthier for everyone.”

Grant funding applications are now being accepted. 501(c)(3) organizations that provide addiction recovery services must email the Philadelphia Foundation in order to begin the application process: GrantmakingServices@philafound.org. Grant funding is derived from the lawful and appropriate use of civil asset forfeiture. The Foundation audits and distributes microgrants.

Evans Welcomes Growing Support for VICTIM Act

Congressman Dwight Evans (D-PA-3rd) is co-leading a $360 million anti-crime and victim aid bill that has picked up bipartisan support in both the House and Senate.

“I’m proud to co-lead this bipartisan bill that would help our state and local police solve more fatal and non-fatal shooting cases. This would be a huge win for public safety in Philadelphia and across the country – district attorneys can’t bring cases that don’t reach them, so this would help make our neighborhoods safer,” Evans said. “As someone who has pushed for help for victims of gun violence, I’m also very pleased that this bill would provide victims and family members with mental health resources and assistance with shelter, wage, and relocation costs.”

Evans said he hopes the bill can build on the recent overwhelmingly bipartisan House passage of a bill that would expand the Child Tax Credit and Low-Income Housing Tax Credit. That bill is pending in the Senate.

Evans said the Violent Incident Clearance and Technological Investigative Methods Act is designed to improve clearance rates for homicides and violent gun crimes by allocating funds for: Hiring and retaining detectives and evidence-processing personnel to investigate and solve, homicides and violent gun crimes; Acquiring, upgrading, or replacing investigative, evidence-processing, or forensic testing technology or equipment; Training detectives and personnel in effective procedures and techniques; Developing evidence-based practices to improve clearance rates; and, Ensuring victims and family members of homicide victims receive mental health treatment, grief counseling, relocation support, emergency shelter, and transportation.

The bill would require grantees to report their use of the funds and how it affected clearance rates to the Department of Justice. Additionally, the National Institute of Justice would conduct periodic evaluations of the grant programs to identify practices and procedures that successfully improved clearance rates for homicides and have potential to be scaled nationally. All reports and data collected from individual grant recipients would be compiled by the DOJ and provided to Congress.

House Delegation praises expanded Child and Dependent Care Enhancement Tax Credit

Members of the Philadelphia House Delegation held a news conference at the Early Learning Literacy Academy highlighting the expansion of the state Child and Dependent Care Enhancement Tax Credit.

This tax credit eases the burden for working families who pay for and rely on child and dependent care in order to work. These families claim this tax credit when they file their federal and state tax returns. Over 27,000 working parents in Philadelphia will see their state tax credits more than triple under the expanded credit.

“Families shouldn’t have to choose between going to work and having quality care for a loved one, or have to work just to pay for care,” said Philadelphia House Delegation Chair Morgan Cephas. “We fought and won for working families prioritizing this significant increase in the Child and Dependent Care Enhancement Tax Credit. I’m elated to know that so many families across Philadelphia will greatly benefit from this increase.”

Pennsylvania will now provide a 100% match to the federal tax credit. Prior to this expansion the tax credit was equal to 30% of the federal credit.

“House Democrats are delivering for all Pennsylvanians – from our students to our seniors to our working families,” said House Speaker Joanna McClinton, D-Phila./Delaware. “Pennsylvania’s improved Child and Dependent Care Tax Credit will help families balance their budgets and businesses whose employees depend on reliable and consistent childcare to go to work.”

The previous one-child credit of $180 goes up to as much as $1,050 depending on household income and expenses for 2023 tax returns. The previous two-or-more children credit of $360 goes up to as much as $2,100 depending on household income and expenses.

“This expanded tax credit for working families is what a people-first agenda looks like,” said House Appropriations Committee Chairman Jordan Harris,” D-Phila. “House Democrats continue moving legislation in a direction that will improve the lives of all Pennsylvanians, young and old, and we look forward to continuing to do what’s best to improve communities in Philadelphia and around the state.”

People who qualify for the federal credit also qualify for the state credit.

“The Child and Dependent Tax Credit enhancement is not only about fiscal policy and numbers – it’s lifechanging support for families, empowering them to succeed in fulfilling careers without the financial burdens,” said state Rep. Malcolm Kenyatta, D-Phila. “It stands as a testament to Democrats’ commitment to empowering families, ensuring that every child’s potential is nurtured, and every family’s journey is marked by opportunity and shared success.”

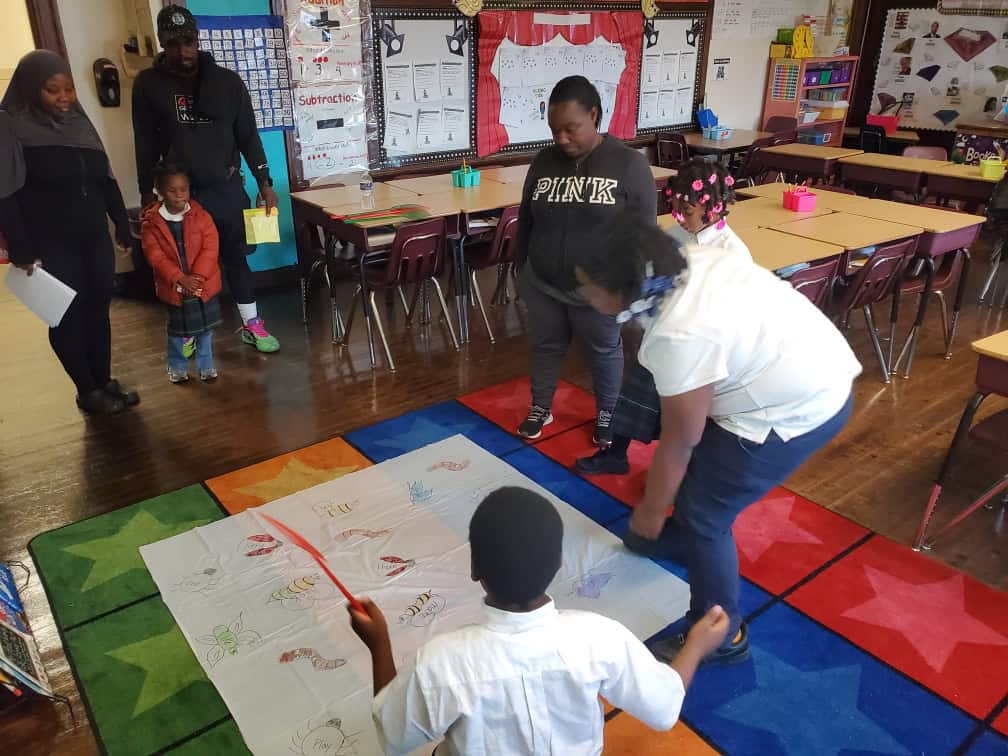

Dental education program

February is National Children’s Dental Health Month, and research shows cavities are the most common childhood disease in the United States.

Doc Bresler’s Cavity Busters Community Outreach dental educators offer a free early childhood dental education program to preschools, daycare centers, elementary schools, day camps and other educational organizations that teach children about proper oral health in a fun and interactive way and how not to be afraid of going to the dentist.

In age-appropriate, 30-minute lessons for children ages 2-6, dental educators teach how to combat cavities with proper brushing and flossing techniques, healthy nutrition and visiting the dentist twice yearly for checkups and cleanings.

The program explains to children what they can expect to see, hear, smell and experience during a dental visit. The lesson allows children to share their individual experiences and emotions in a supportive format, with any early misconceptions or misinformation explained away. When the program is over, each child goes home with a goody bag containing a new toothbrush, coloring book, stickers and important parent information that reinforces lessons they have learned and encourages them to practice good dental hygiene at home.

The early dental education program is available year round. For information, email community@cavitybusters.com.

For more early childhood oral and dental health information, visit cavitybusters.com.

Doc Bresler’s Cavity Busters is home to eight Philadelphia and suburban locations, including one at 330 Oregon Ave. ••

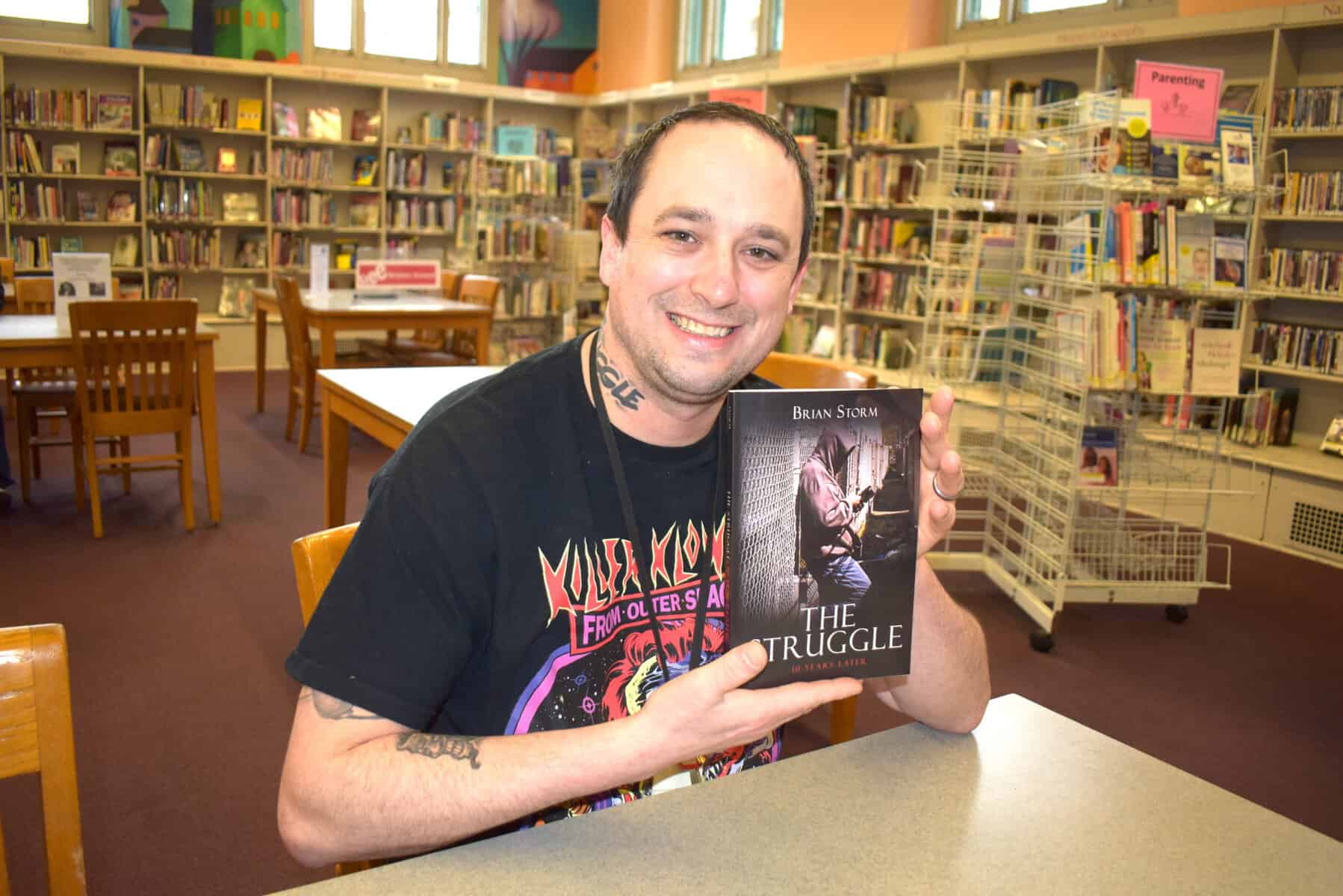

Support Storm the Heavens

Storm the Heavens Fund will hold its sixth annual Bean’s Ball on March 9 at 7 p.m. at Vie, 600 N. Broad St.

The masquerade ball will be held in memory of Philomena “Bean” Stendardo, an 8-year-old from Port Richmond who died in 2017 of Diffuse Intrinsic Pontine Glioma, a fatal form of brain cancer that mostly affects kids under 11.

Philomena’s parents, Mark and Mina, started the Storm the Heavens Fund to spread awareness and fund research for DIPG.Tickets cost $275. For information on tickets, sponsorships and event booklet ads or to make a donation, visit StormTheHeavens.org. ••

Sign up for senior softball

The Philadelphia Senior Softball League is looking for experienced players for its 68-and-over and 58-and-over leagues. The 58-plus teams play Tuesdays and Thursdays. The 68-plus teams play Mondays and Fridays. All games start at 10 a.m. and are played at Crispin Fields, at Holme and Convent avenues. Games start mid-April and run till the end of September. No games in July. For the 58-plus league, call Mike Bojanowski at 215-801-4869. For the 68-plus league, call Marty King at 215-409-5021. ••

VFW looking for members

Bustleton-Somerton/CTR1 Michael J. Strange VFW Post 6617 meets on the third Wednesday of every month at American Legion Post 810, 9151 Old Newtown Road.

Meetings start at 7:30 p.m.

If you are a military veteran who served in a designated combat zone, you are eligible to join the VFW.

Contact Commander Israel Wolmark at 215-725-0630 if you would like to join the post. ••

Trip to Northern Europe

The Bristol Cultural and Historical Foundation is presenting a Northern Europe: Iceland, Norway, Netherlands, Belgium and London cruise, July 25 to Aug. 4, 2024, aboard the new “Norwegian Prima.”

Rates per person are $6,261 and $6,495, which include roundtrip airfare from Philadelphia.

Deposit of $350 per person double occupancy is required when booking.

Final payment by Feb. 27.

Call 215-788-9408. ••

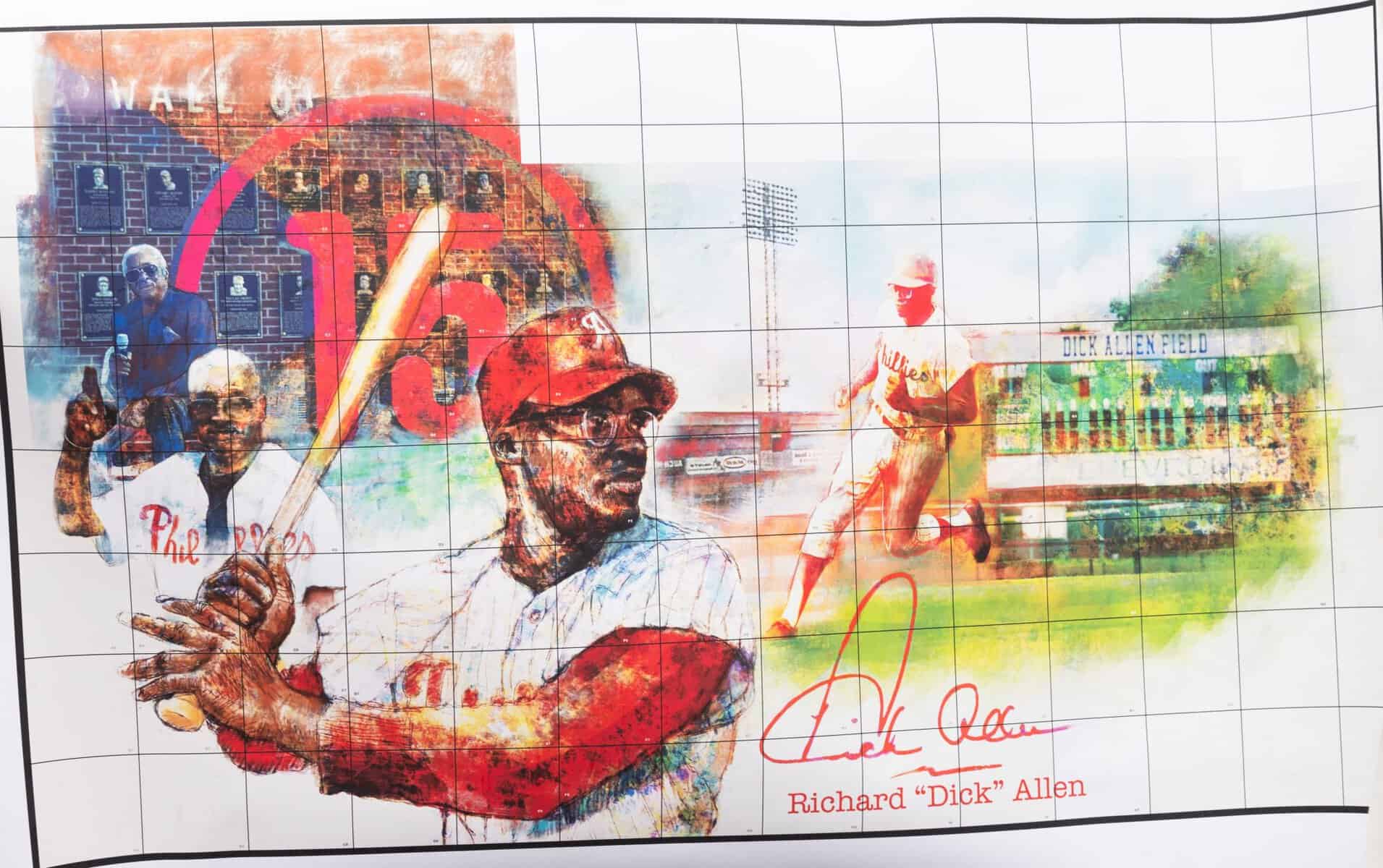

Ballot released for Philly Sports Hall of Fame

The Philadelphia Sports Hall of Fame has released the ballot for its 21st class of inductees.

Brief career profiles for the nominees can be found at http://phillyhall.org/profiles.pdf

The Hall of Fame offers fans an opportunity to select their favorites from the ballot, though it’s not part of the official voting.

Living nominees are Andy Talley – Football; Art Still – Football; Brendan Hansen – Swimming; Chase Utley – Baseball; Cheryl Reeve – Basketball; Christy Morgan – Field Hockey; Clyde Simmons – Football; David Reid – Boxing; Donald Haldeman – Marksmanship; Dwight Muhammad Qawi – Boxing; Eddie Coyle – Paralympics-Powerlifting; Erik Williams – Football; Gail Ramsay – Squash; Jameer Nelson – Basketball; Jim Foster – Basketball; Mandee Amanda O’Leary – Lacrosse; Mary Ellen Clark – Swimming; Mike Rozier – Football; Paul Westhead – Basketball; Rod Brind’Amour – Hockey; Ryan Howard – Baseball; and Stan Walters – Football.

Heritage nominees are A.W. Tillinghast – Golf; Alice Putnam Willetts – Field Hockey/Lacrosse; Andrew Matter – Wrestling; Battling Levinsky – Boxing; Bertha Townsend Toulmin – Tennis; Charles Moore – Track & Field; Douglas Stewart – Soccer; E. Carroll Schaeffer – Swimming; Eddie Stanky – Baseball; Frank Spellman – Weightlifting; G. Diehl Mateer Jr. – Squash; George Benton – Boxing; George Munger – Football; Harry Schuh – Football; Joan Moore – Gymnastics; Ken Myers – Rowing; Mendy Rudolph – Basketball; Ralph Morgan – Basketball; and Roy Thomas – Baseball.

Fans may submit their selections online at http://phillyhall.org/fansvoice

The induction ceremony and reception will be Nov. 7 at Live! Casino & Hotel. ••

March book club

The Book Club of Congregations of Shaare Shamayim will be hosting a Zoom session on Monday, March 4, at 7 p.m. The book is The Star Crossed Sisters of Tuscany by Lois Nelson Spielman. To register or for more information, call Lynn Ratmansky at 215-677-1600. ••

Bingo in March

The Sisterhood of Congregations of Shaare Shamayim is hosting bingo on Zoom on Mondays, March 11 and March 18, starting at 7:30 p.m. The cost is $36 per person and includes two cards for eight games of bingo each night. Send your payment to the CSS office, 9768 Verree Road, Philadelphia, PA 19115, attention: Bingo. Payment must be received no later than Feb. 26. Include your email address to receive the Zoom link. Call Gerry or Nancy at 215-677-1600. ••

April book club

The Book Club of Congregations of Shaare Shamayim will be hosting a Zoom session on Monday, April 1, at 7 p.m. The book is The Gown by Jennifer Robson. To register or for more information, call Lynn Ratmansky at 215-677-1600. ••